The share price of Pointsbet Holdings Ltd (ASX: PBH) is falling today… not a celebratory Gatorade deluge.

Friday afternoon has shareholders driving the price of the company’s shares down 8.2% to $1.52. The negative reaction follows the release of Pointsbet’s fiscal year 23 third-quarter results this morning.

Initially, the market responded positively, increasing the betting platform’s stock price by 9 percent. Investors have assimilated the information contained in the quarterly report, and the excitement has since subsided.

Examine the chamber or endure the sell-off

Pointsbet shareholders are not holding back as the company’s stock price plummets today. Here are the most significant statistics from today’s report:

- Total sports wagering revenue increased 4% annually to $1,449.9 million.

- The net gain from sports betting increased by 28% to $91.2 million.

- iGaming net revenue increased 181% to $15.4 million

- Total group net profit increased 39% to $106.6 million

- Net cash discharge of $88,7 million during the third quarter Cash on hand at the end of March 31, 2023, amounting to $251.7 million

The market appears unimpressed by Pointsbet’s top-line growth in the most recent quarter, which coincided with sustained bottom-line losses. Such losses are anticipated to continue in the second half, adding to the force restraining the share price of Pointsbet.

The company expects normalized group EBITDA losses to range between $77 million and $82 million in the second half of fiscal year 2023. However, a recent cost evaluation of Pointsbet’s North American operations resulted in a 12 percent reduction in staff.

Positively, net wins increased while marketing and promotion expenses were reduced. These items were reduced by 12% and 28%, respectively, in comparison to the prior comparable period.

As economic headwinds swirl, the market appears reluctant to reward Pointsbet despite its efforts. In contrast, the share price of Megaport Ltd (ASX: MP1) has skyrocketed today due to its emphasis on positive EBITDA.

What other factors could affect the Pointsbet share price?

Pointsbet is in talks with a number of stakeholders regarding a potential transaction for its North American business. According to the press release, this is being done in an effort to “add value for our shareholders.” These negotiations are described as “well along.”

In addition, management maintains an open channel of communication with interested parties in the Australian business. It was noted, however, that these discussions are not with the potential suitors mentioned in media speculation on December 27, 2022.

Regardless of the outcome, many shareholders have decided to abandon ship today.

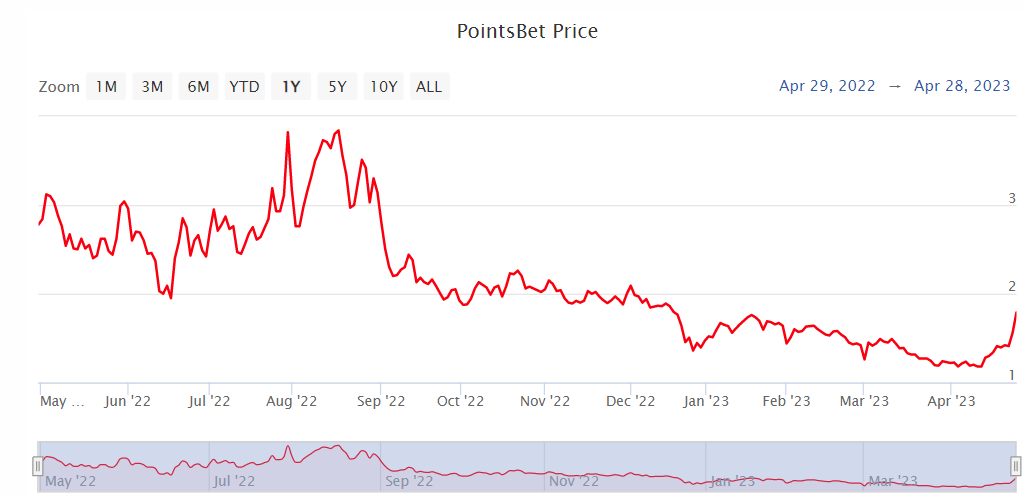

The share price of Pointsbet is 41.7% lower than it was one year ago. During the same time frame, the S&P/ASX 200 Index (ASX: XJO) is approximately unchanged.