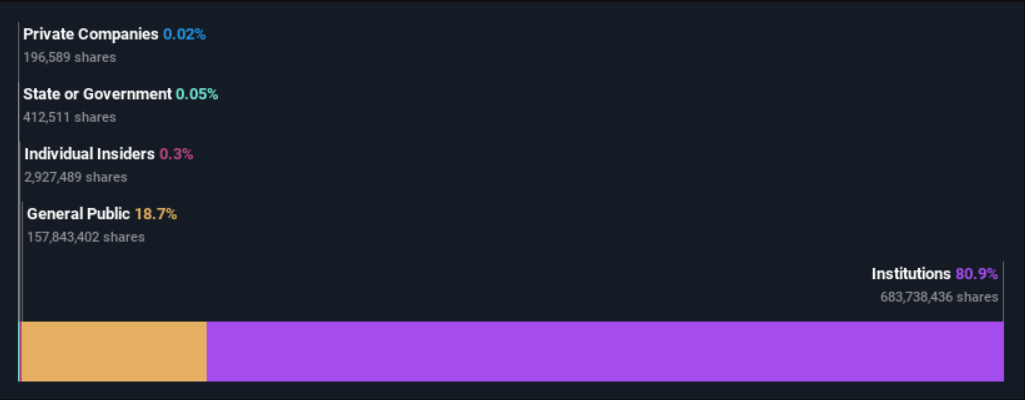

If you want to determine who truly controls Applied Materials, Inc. (NASDAQ:AMAT), you must examine the company’s share registry. We can see that 81 percent of the company’s ownership is held by institutions. In other words, the utmost upside potential (or downside risk) confronts the group.

Institutional owners’ investing decisions tend to bear a great deal of weight, particularly among individual investors, due to their vast resources and liquidity. Therefore, having a substantial quantity of institutional capital invested in a company is frequently viewed as a desirable characteristic.

What Does Institutional Ownership of Applied Materials Tell Us?

Numerous institutions evaluate their performance relative to an index that represents the local market. Consequently, they devote greater attention to companies that are included in important indices.

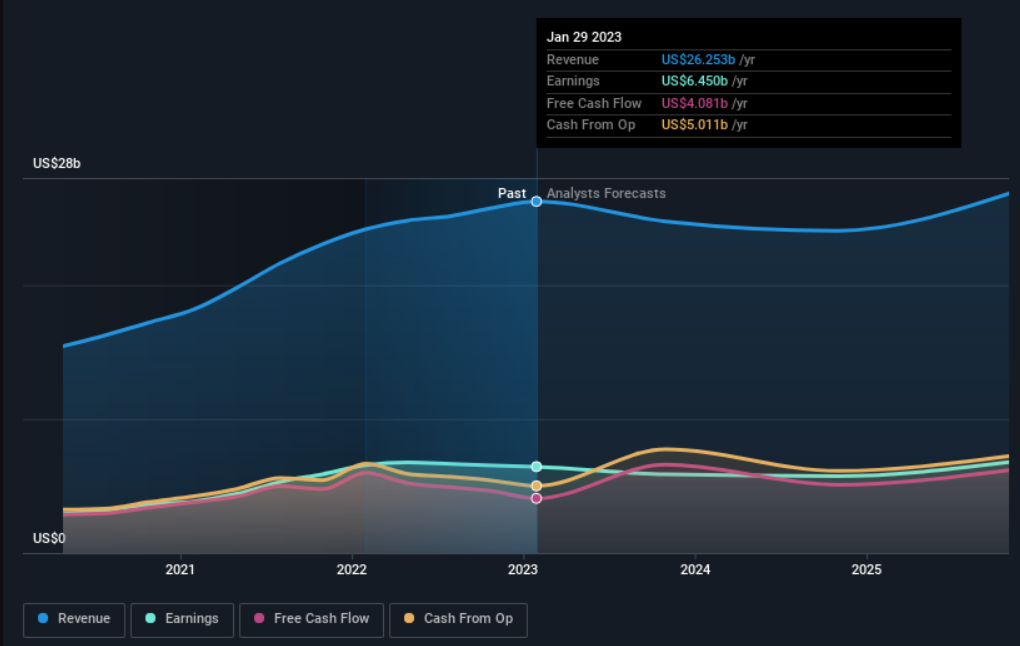

There are already institutions listed on the Applied Materials share registry. In fact, they hold a substantial stake in the company. This indicates a degree of credibility among professional investors. However, we cannot rely solely on this fact because institutions, like everyone else, occasionally make poor investments. It is not uncommon for a stock’s price to decline significantly if two large institutional investors attempt to sell at the same time. Consequently, it is prudent to examine Applied Materials’s past earnings trend (below). Obviously, there are additional factors to consider as well.

Over fifty percent of the company is owned by institutional investors, so they can presumably exert considerable influence over board decisions. The company is not owned by hedge funds. 8.7% of the company’s stock is owned by The Vanguard Group, Inc., the largest shareholder. The second and third largest shareholders possess 8.2% and 7.2%, respectively, of the outstanding shares.

The top 25 shareholders collectively control less than half of the company’s shares, indicating that the shares are broadly dispersed and that there is no dominant shareholder.

While it makes sense to examine institutional ownership data for a company, it also makes sense to examine analyst sentiments in order to determine the direction of the wind. Numerous analysts cover the stock, so it is simple to examine growth projections.

Ownership By Insiders Of Applied Materials

Although the precise definition of an insider can be subjective, virtually everyone agrees that board members are insiders. The company management should report to the board, and the board should represent shareholder interests. Notably, sometimes executive-level administrators serve as board members.

When insider ownership indicates that management is thinking like the company’s true proprietors, it is advantageous. Nonetheless, high internal ownership can grant enormous influence to a small group within the organization. This can be detrimental in certain situations.

According to our data, insiders own less than 1 percent of Applied Materials, Inc. in their own names. Given the company’s size, we would not expect insiders to hold a significant proportion of the stock. Collectively, they own shares worth $332 million.

It is encouraging to see board members owning shares, but it may be worthwhile to determine whether these insiders have been purchasing.

General Government Ownership

The general public, consisting primarily of individual investors, has some influence over Applied Materials, as they own 19% of the company. Although this group cannot necessarily call the decisions, it can have a significant impact on how the company is managed.