In April, Indian markets defied increasing interest rates, surprising analysts. A constant stream of good macroeconomic signs and a drop in valuations drew $1.13 billion in stock movements, causing this unexpected turn of events.

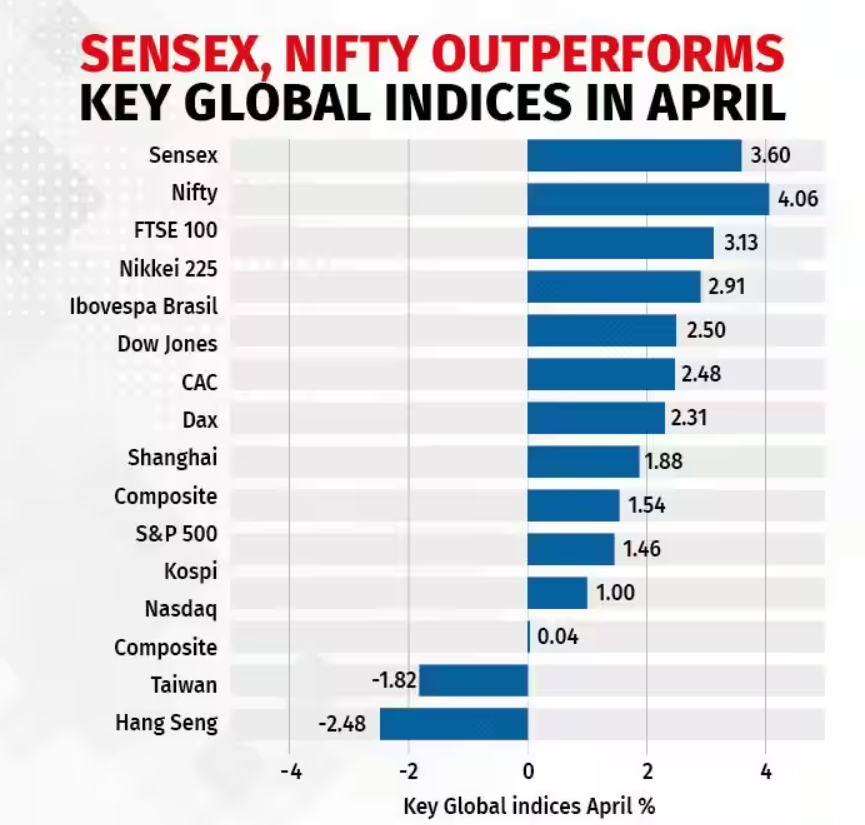

Thus, the benchmark Sensex and Nifty led major global equity markets for the month.

“India seems to be back in favour in April 2023 as far as FPI flows are concerned,” said HDFC Securities Head of Retail Research Deepak Jasani. “This may be due to a rise in risk appetite globally (and more so in emerging markets) on expectation of interest rate hikes and Indian macro numbers continuing to come in better than expected, relieving some micro concerns, too.”

April FIIs bought $1.13 billion in local equities. Repurchased FIIs. FII net selling down $1.83 billion from $4.3 billion in February 2023.

April saw Sensex and Nifty rise 3.6 percent and 4.06 percent. Other global markets gained 1.46 percent, Nasdaq Composite 0.04 percent, CAC 2.31 percent, DAX 1.88 percent, Kospi 1 percent, Nikkei 225 3 percent, Shanghai Composite 1.5 percent, FTSE 100 3.13 percent, Dow Jones and Ibovespa 2.5 percent apiece. Taiwan lost 1.8 percent, Hang Seng 2.5 percent.

Investor mood has improved due to lower consumer price inflation and a stop in RBI interest rate rises. S&P Global reported on April 5 that India’s services sector increased again in March, although its Purchasing Managers’ Index (PMI) fell to 57.8 from February’s 12-year high of 59.4.

April GST collection was a record Rs 1.87 lakh crore. This tops previous year’s record Rs 1.68 lakh crore.

China has attracted the most foreign equity investment this year, $48.19 billion, according to Bloomberg. Japan receives $13.96 billion, Indonesia $11.27 billion. However, FIIs sold $40.74 billion in US equities. In Thailand, FIIs sold $1.88 billion in shares, and in the Philippines and Malaysia, they sold $500 million.

Foreign outflows increased in January-March as investors took advantage of China’s cheaper equities markets. According to Gaurav Dua, Senior VP – Head of Capital Market Strategy at Sharekhan by BNP Paribas, the robust advance in China and a correction in Indian markets decreased the valuation difference by March 2023, easing selling pressure.

The US financial crisis forced the Federal Reserve to restore liquidity taps, reversing quantitative tightening. Dua said the US central bank’s balance sheet growth has caused a worldwide risk-off trade, benefiting emerging markets.

Investors anticipate the US federal reserve meeting this week. This week, the Federal Reserve is expected to raise its benchmark interest rate by 25 basis points to above 5%. This is to reduce inflation, which is substantially above the Fed’s objective.