Timken (NYSE:TKR) will report earnings Wednesday morning. Analysts and investors eagerly await the Q1 financial report. Timken’s FY23 forecast of $6.50-$7.10 EPS and Q1 EPS consensus of $1.84 suggest ongoing profitability.

In addition to analysts’ predictions for Timken’s future performance, seasoned investors are interested in CEO Richard G. Kyle’s recent 24,841 share transaction.

Kyle sold at $85.97 per share on Monday, February 27th, for $2,135,580.77.

Despite such sales, Timken performed well overall, demonstrating a dividend distribution ratio (DPR) of 22.63%, quarterly dividends to shareholders, and consistent profit guidance for our three financial years monitored closely by stakeholders.

As Timken prepares to present its newest performance data and future growth and development plans this week, several doubts remain: Will these numbers predict industrial yields? – What have dividend payouts taught us? In conclusion, investors and industry aficionados concerned about this key area’s sustainability efforts in volatile markets may find May 3rd a worthwhile conversation starter.

Leading industrial products manufacturer Timken reported quarterly earnings that exceeded market estimates. The company topped the consensus expectation of $1.09 by $0.13 with EPS of $1.22. Timken’s quarterly revenue rose 7.4% to $1.08 billion with a net margin of 9.06% and return on equity of 19.52%.

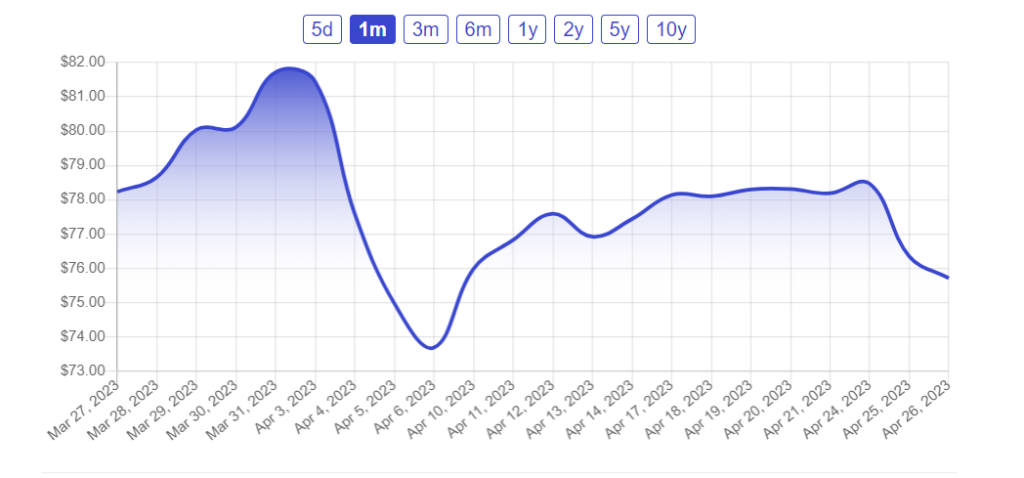

Timken shares started Wednesday at $76.35, compared to a one-year low of $50.85 and high of $89.40. Industry analysts’ confidence keeps Timken investors optimistic.

As reported by Bloomberg.com, Citigroup raised its price objective on Timken from $78 to $98 and gave the stock a “buy” rating, while Goldman Sachs gave it a “neutral” rating and raised their price objective from $70 to $79; KeyCorp gave Timken a “overweight” rating with a goal of well over $100; and Oppenheimer upgraded their projection for Timken from to an impressive range between $88–90 with a “outperform” rating. Bank of America raised grades and predictions late last year.

Most analysts give this industrial products player buy and buy ratings and bullish expectations.

All these key indicators point to strong growth prospects for Timken going forward—a view that seems widely held given the current business environment for top industrial stocks like itself and renewed emphasis on efficient supply chains throughout world markets—a business Timken is well-poised to profit on given its rich history in the field. Thus, if expert predictions are correct and the company streamlines strategic operations and advances next-generation technologies, this global behemoth’s stock is worth watching for savvy investors seeking long-term gains from solid companies that can make serious profits in today’s challenging business environment.