Trends in the transportation industry heading into the second quarter and the middle of the year continue to be a barometer for the global economy.

As leading economic indicators and recent news developments suggest at the upcoming status quo, implementing autonomous logistics across your conveyance operations increases your control over costs and customer service.

Condition of Freight

The Logistics Managers’ Index recorded its lowest reading ever in March as transportation prices reached a “all-time low” and transportation utilization showed no increase for the first time since 2023.

As evidenced by a 6% decline in the Cass Truckload Linehaul Index, which is comprised of spot and contract freight rates, freight demand and rates fell in the first quarter due to wholesalers and retailers’ excess inventory. Given the present combination of capacity and sluggish demand, the spot rate floor is dubious.

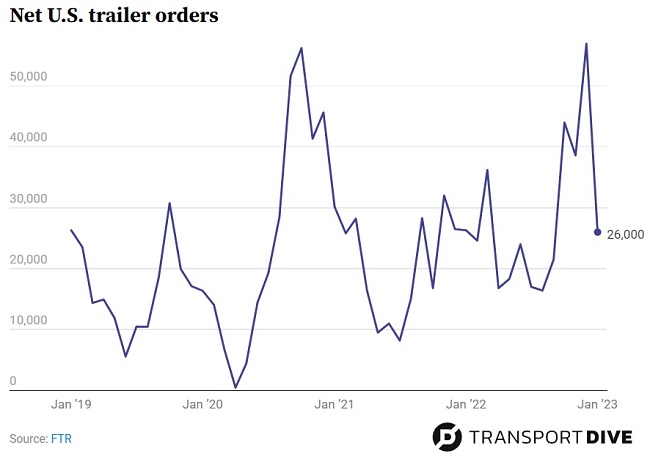

In March, orders for Class 8 vehicles fell to 19,200 units, a 10% decrease from the same month last year. In February (y/y), sales of used Class 8 trucks decreased 19.6%, while the average price declined 23.3%. Likewise, trailer orders decreased from a record high in December and more than 346 thousand in 2022 to just 26,000 in January.

Spot rates have decreased by 90 percent from their pandemic-era peaks, resulting in substantial savings for businesses transporting products internationally. U.S. imports in February were down 25% (y/y), and international demand declines are most pronounced for West Coast ports, where supply chain participants are urging the White House to intervene in West Coast port labor negotiations that have been ongoing since May 2022.

Security is the main focus

Gartner predicts that by 2025, sixty percent of supply chain organizations will use cybersecurity risk as a significant factor in third-party transactions. By 2026, one-third of supply chain organizations will utilize industry cloud platforms.

The global 3PL market revenue reached $1.47 trillion in 2017, a 14.5% increase over 2021 and nearly double the level of 2016.

Security concerns extend to freight shipments, and food and beverage cargo larceny increased by nearly 50 percent from January to February. Theft of cargo costs transportation companies and retailers between $15 and $30 billion annually, according to the FBI, and contributes to supply chain disruptions that have fueled inflation.

Reasons for Hope?

Slower capacity expansion in March offers optimism that the freight downturn may be nearing its conclusion. The forecast of 4-6% retail sales growth in 2023 by the National Retail Federation would help reverse the tide.

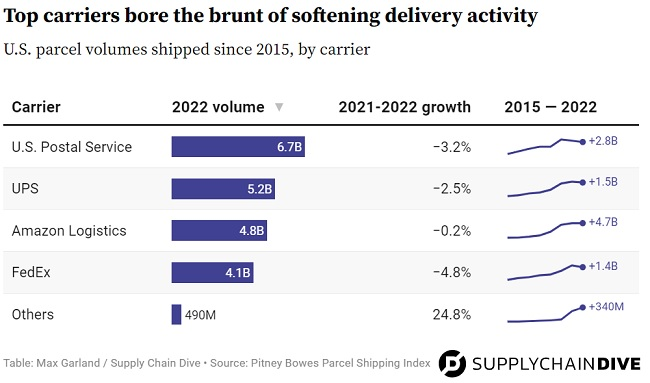

Even after parcel carriers saw a 2.2% decline in volumes (and a 6.2% rise in revenue), e-commerce demand will continue to play a role. Even though U.S. e-commerce reached $1 trillion for the first time in 2017 and accounted for 14.6% of total retail sales, volume growth is anticipated to continue to decelerate.

And while weaker freight demand also impacts diesel fuel prices, nine consecutive weeks of price declines may be a sign of economic trouble. The average price of on-highway diesel in the United States decreased to $4.105 per gallon on April 3, the lowest price since February 28, 2022 ($4.104). However, crude prices are soaring in response to Saudi Arabia’s intentions to reduce output.

What else warrants attention?

- Balancing E-commerce and Freight Demand Patterns

- Cargo Theft Is Rising, According to Reports: How You Can Help Prevent It

- Logistics Visibility: Expectations for a TMS

- Digital Supply Chain Transformation: Are Inaccurate Data Causing Destruction?