The 2023-24 Budget allocates Sh10.7 billion to small companies.

The administration added Sh10 billion to the Hustler Fund for low-income citizens, women, youth, and SMEs.

Women Empowerment Fund Sh182 million, Youth Enterprise Development Fund Ssh75 million, Uwezo Fund Sh192 million, and Sh300 million to manufacturing SMEs.

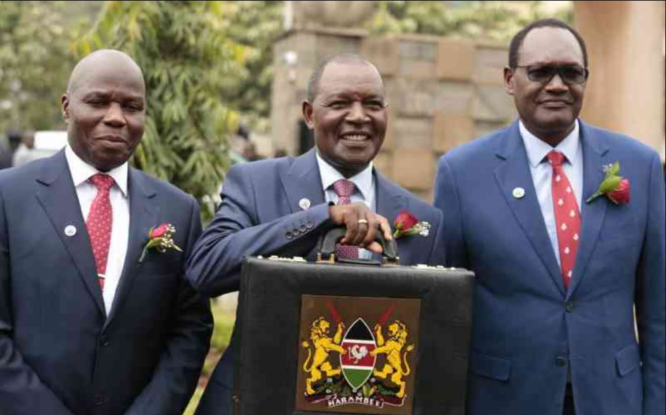

“These allocations will inevitably guarantee access to affordable credit to hustlers, households, and MSMEs, and therefore accord them opportunities to make their rightful contribution to nation building,” stated National Treasury Cabinet Secretary Njuguna Ndung’u.

The government thinks the Hustler Fund and other affirmative funds would boost selected individuals and industries’ access to cheap credit and investment, leading to private sector-led growth.

The Hustler Fund is in addition to the Sh11 billion the government has committed on financial inclusion.

“This money has been revolving within the fund, providing low-interest loans at eight percent per annum to 16.07 million Kenyans, of which 7.1 million are repeat customers,” Prof. Ndung’u said in his Budget Statement on Thursday.

“This revolving fund has borrowed Sh30.8 billion.”

The CS’s National Assembly presentation included several business-boosting initiatives.

The Competition Authority of Kenya (CAK) exempts micro and small firms from merger notifications, helping start-ups and digital businesses.

The CS said that CAK will monitor and audit the manufacturing and agro-processing sectors to protect MSMEs against buyer power abuse.

Ndung’u said Kenya’s capital markets continue to mobilize savings and investments for productive entrepreneurship.

The Capital Markets Authority drafted the Capital Markets (Public Offers and Disclosures) Regulations, 2023 to help MSMEs raise loan and equity capital via the Nairobi Securities Exchange.

“The authority is also implementing the Capital Markets (Investment Based Crowdfunding) Regulations, 2022 to support Kenyan Start-ups to raise finance from global and local investors,” he added.

MSMEs would also be affected by the plan to lower excise tax from 20% to 15% on fees imposed by banks, money transfer agencies, and other financial service providers for telephone and internet data services and money transfer services.

Treasury also recommended reducing excise duty on money transfer fees levied by cellular phone service providers or National Payment System-licensed payment service providers from 12 to 10% of the excisable amount.

The CS stated this would boost MSMEs’ retail sales.

To safeguard depositors from financial instability induced by inflation and rising interest rates, the Kenya Deposit Insurance Corporation is reconsidering its Sh500,000 coverage limit.