The leaders of Australia’s largest corporations have every right to shake their heads at the $8.6 billion tax increase on businesses and property owners announced in the Victorian state budget on Tuesday.

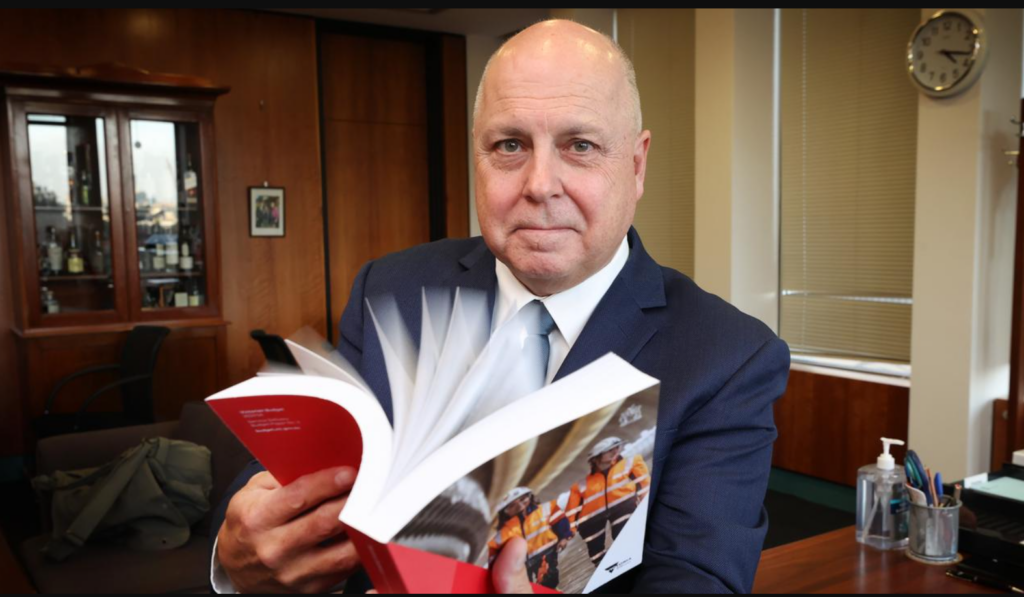

They will be angered by Tim Pallas’s characterization of them as pandemic profiteers.

They will be dismayed by the addition of $4 billion in payroll tax increases for businesses to the astronomical 42% increase in Work Cover premiums.

And they will be perplexed by the fact that large business is now expected to shoulder the burden of the record-breaking COVID-19 lockdowns, which they warned at the time could cause long-term economic suffering.

Once the anger subsides, however, the leaders of large businesses – and even smaller ones, given that the new payroll tax impost applies to businesses with payrolls of more than $10 million – should be concerned about the emergent pattern of one-sided pressure on government expenditure.

Pallas has funded its budget centerpiece solely through large corporations.

In 2021, it was a $3 billion tax to finance a significant increase in mental health expenditures. Two years later, Pallas has returned to the same well with an identical message: buck up.

And while Pallas may characterize the payroll tax and property tax as temporary, these levies will remain in effect until 2033. But what new policy will require funding in the interim? What budget deficit will need to be filled?

At a time when demographics are eroding the tax base, it is paradoxical that the detailed discussion of pandemic expenditure in the Victorian budget papers has helped entrench an era in which governments are expected to intervene in more sectors and in more ways.

At the state level, these expenditure priorities include health and infrastructure, and at the federal level, geriatric care and defense. Tomorrow’s priorities may include incentives to attract talent to counteract the effects of an aging population, as well as assistance for employees displaced by artificial intelligence. The challenge of combating climate change will span multiple generations.

Governments will need to make more prudent expenditure decisions, and it should be noted that Pallas has attempted to do so with 4,000 employment cuts in the public sector. However, they are also in the business of reelection, and there are limits to how far they will cut expenditure.

Governments around the globe are battling to balance rising expenditure challenges with deteriorating revenue projections. Obviously, none of this is simple.

However, Tuesday’s budget suggests that Victoria has found a politically expedient solution: punishing large business.